Car Loan Eligibility in India: How to Qualify & Improve Your Chances of availing car loan | SBI - Yono

Car Loan Eligibility in India: Explore YONO SBI for More

28 Nov, 2025

car loan

Owning a car has evolved from being a luxury to a necessity in today's fast-paced world. Whether it's your first vehicle symbolising newfound freedom, a reliable companion for daily commutes or an upgrade to accommodate your growing family's needs, a car loan makes these automotive dreams achievable without the burden of paying the entire amount upfront. However, securing a car loan isn't just about walking into a bank – understanding car loan eligibility is crucial for a smooth approval process.

With India's automotive financing landscape becoming increasingly competitive, knowing how to navigate car loan eligibility requirements can save both time and money. This comprehensive guide will walk you through everything you need to know about qualifying for a car loan in India and how YONO SBI's digital platform can streamline your online car financing journey with instant car loan approval.

Car Loan Eligibility Criteria

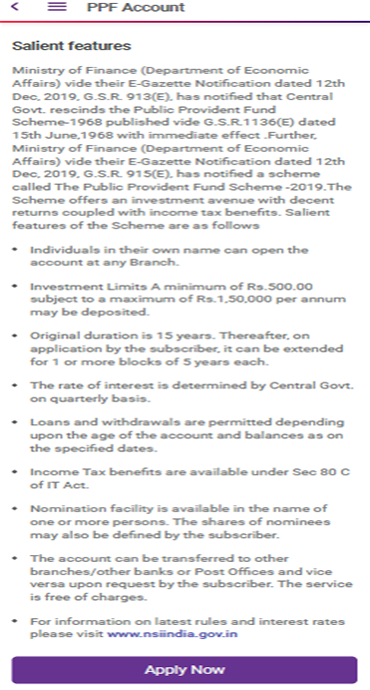

Car loan eligibility refers to the comprehensive set of financial, personal and professional criteria that lenders evaluate to determine whether an applicant qualifies for vehicle financing.

The car loan eligibility assessment goes beyond just checking your income – it encompasses your credit history, employment stability, existing debt obligations and overall financial health. Understanding these car loan criteria is essential because they directly impact not only your loan approval chances but also the car loan interest rates, loan amount and repayment terms you'll be offered.

Here are the fundamental criteria for availing car loan in SBI:

Age Requirements:

You must be between 21-70 years of age at the time of applying for a car loan. This ensures you are legally capable of entering into financial contracts and have sufficient earning years remaining to repay the loan comfortably.

Income Thresholds:

The minimum salary for car loan eligibility in India typically ranges from ₹3 lakhs to ₹4 lakhs annually depending on the lender and your profession. For instance, SBI requires a minimum annual income of ₹3 lakh for salaried employees and for self-employed professionals/businessmen the net profit or gross taxable income should be Rs.3 lakh per annum while agriculturists need ₹4 lakh net annual income.

Employment Stability:

Lenders prefer applicants with at least 1-3 years of stable employment or business continuity. This demonstrates earning consistency and reduces the risk of income disruption during the loan tenure, directly affecting your car loan criteria assessment.

Citizenship and Residency:

You must be an Indian resident with valid address proof.

Credit Score Requirements:

While the car loan eligibility credit score from Credit Information Companies (such as CIBIL, Experian, etc.) may vary, most banks prefer a minimum score of 700-750 for smooth approvals. A higher credit score can help you secure better car loan interest rates.

Debt-to-Income:

Lenders calculate your existing EMI obligations against your monthly income. Lower debt improves your chances to get loan approval without rejection and helps you calculate car loan eligibility more favourably.

Down Payment Capacity:

Although banks provide 100% on-road financing, a higher down payment reduces the loan amount required, which improves your eligibility profile and potentially secures better auto payments terms and competitive car loan interest rates.

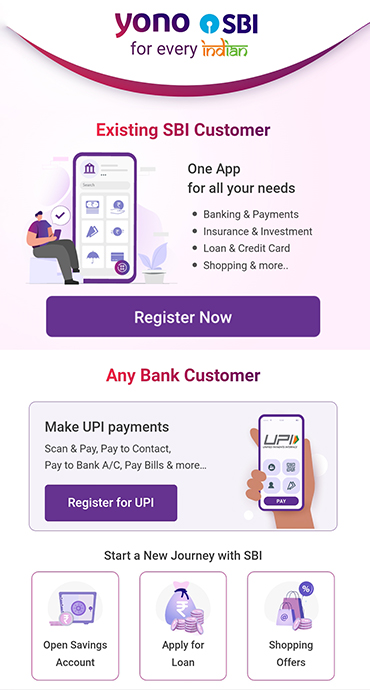

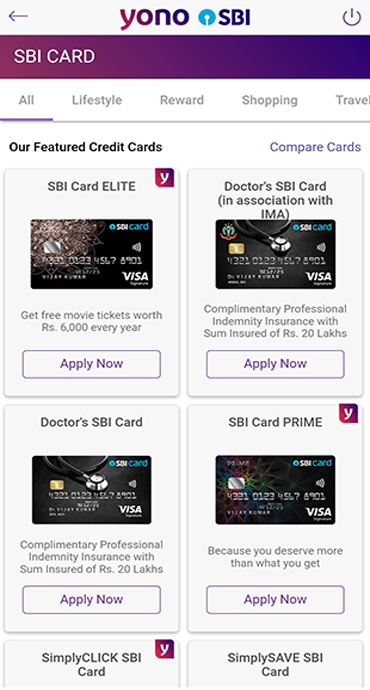

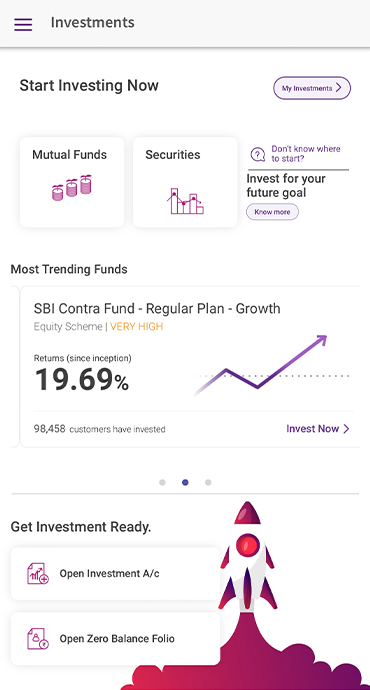

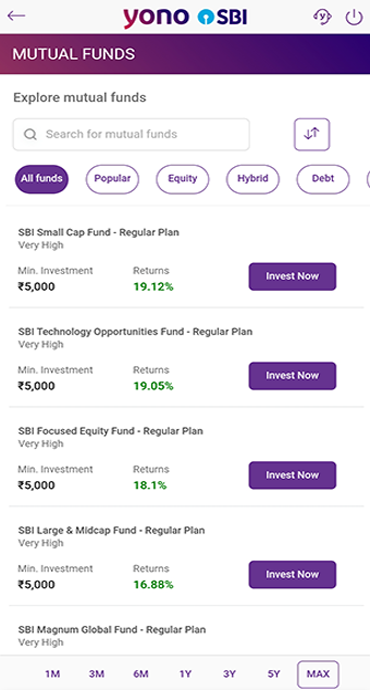

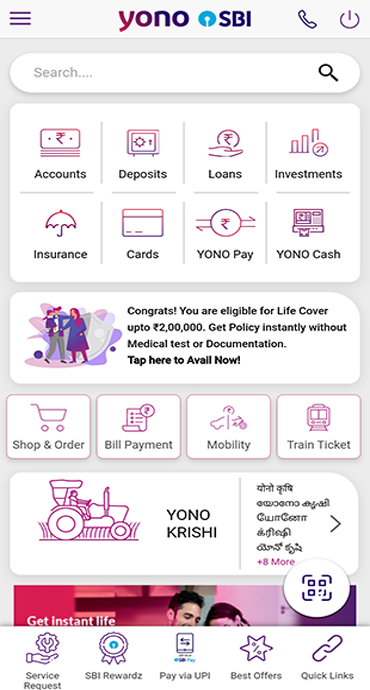

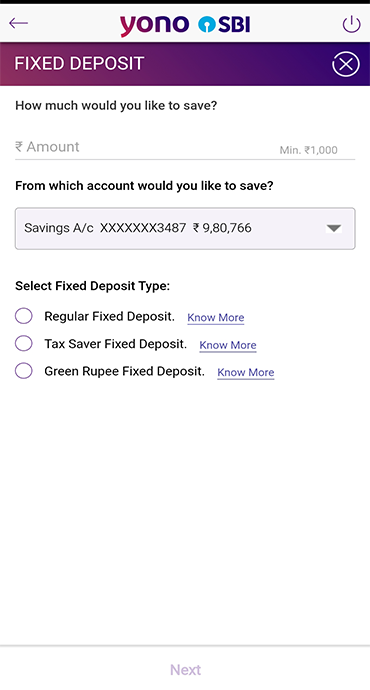

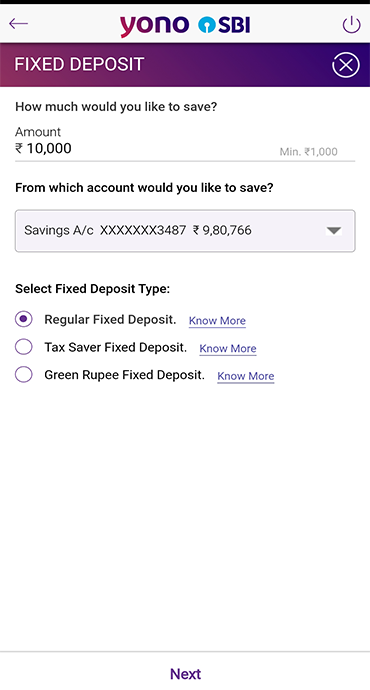

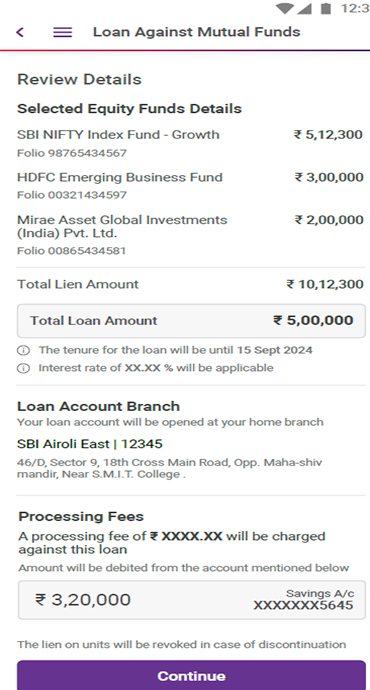

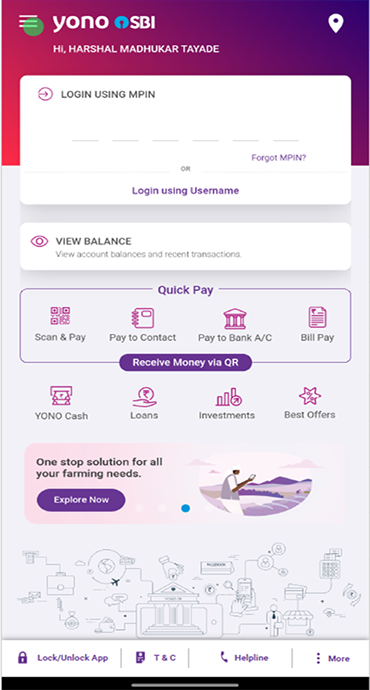

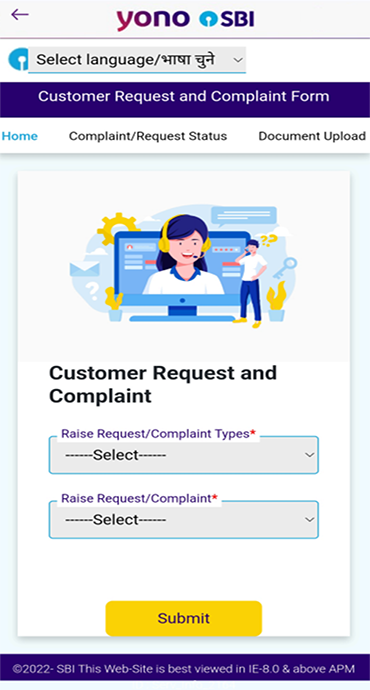

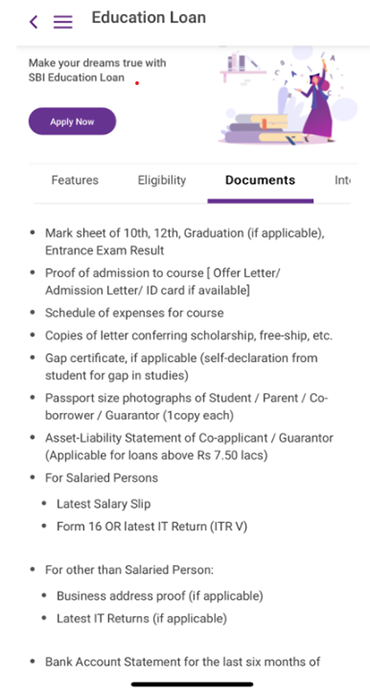

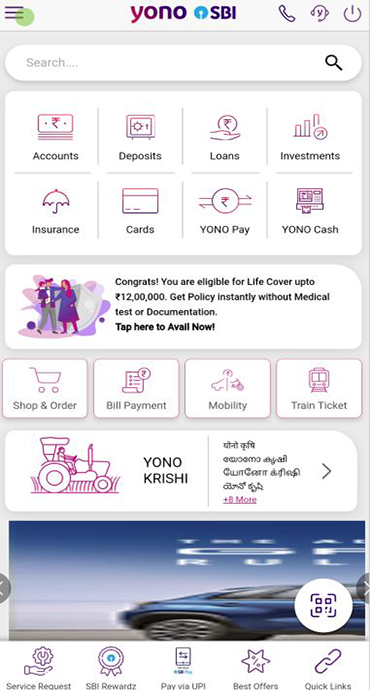

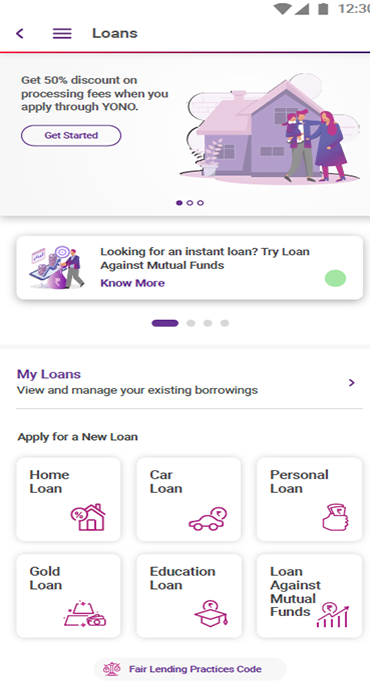

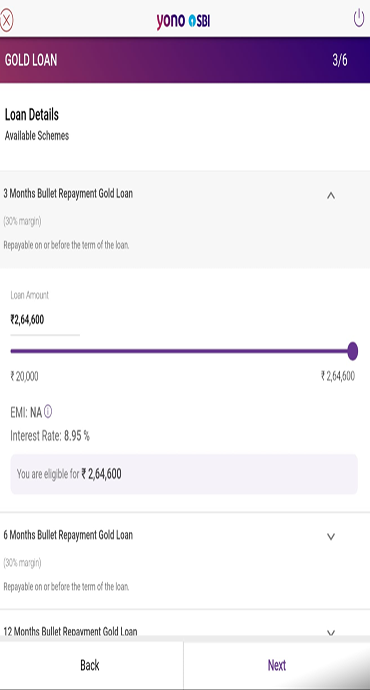

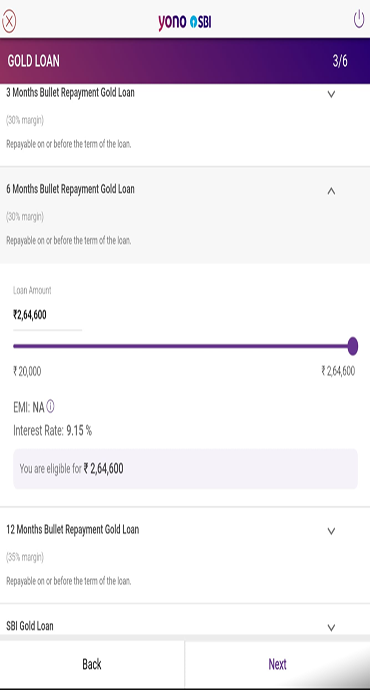

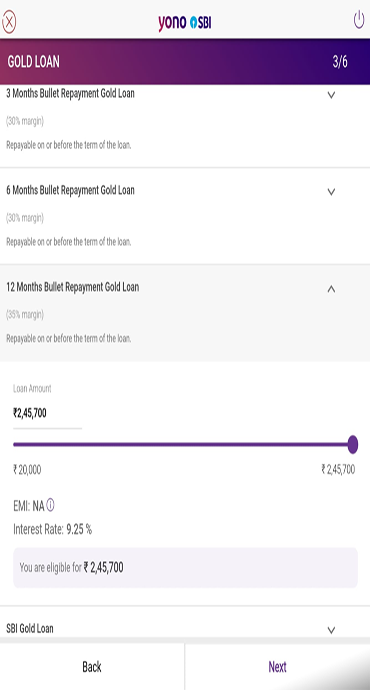

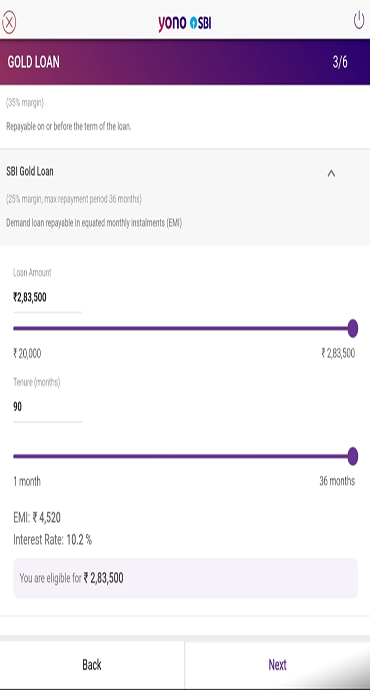

How to Avail a Car Loan via YONO SBI

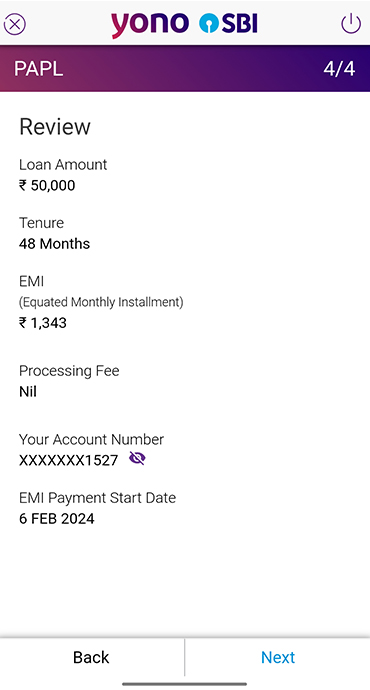

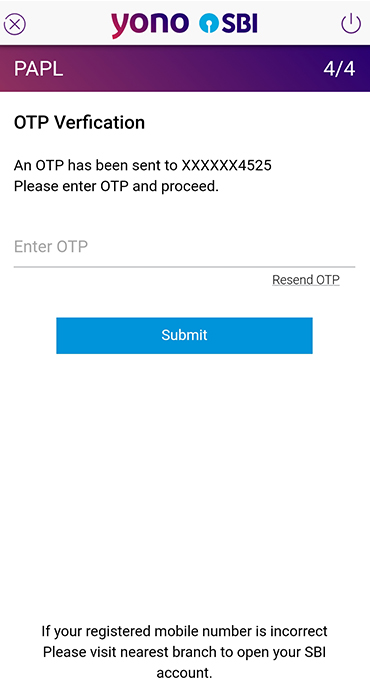

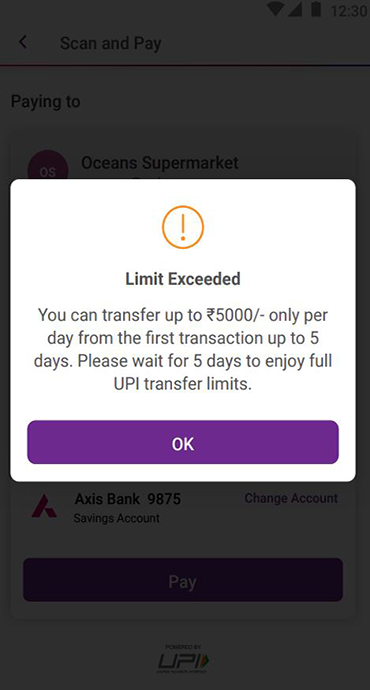

The car loan application process in YONO SBI is designed for convenience and speed, allowing you to check car loan eligibility and calculate car loan EMI in just a few steps:

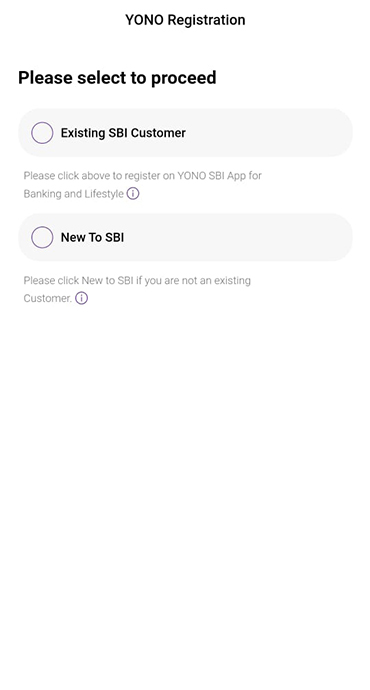

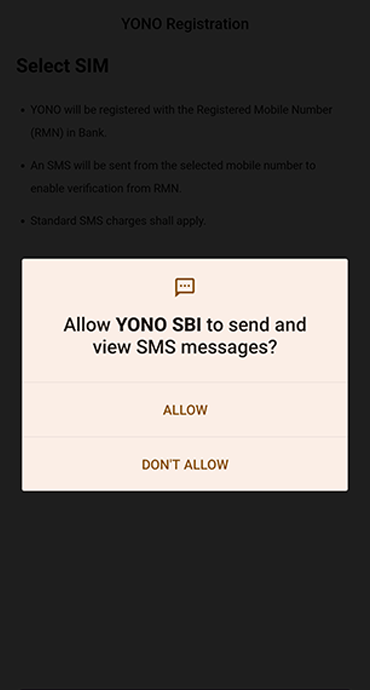

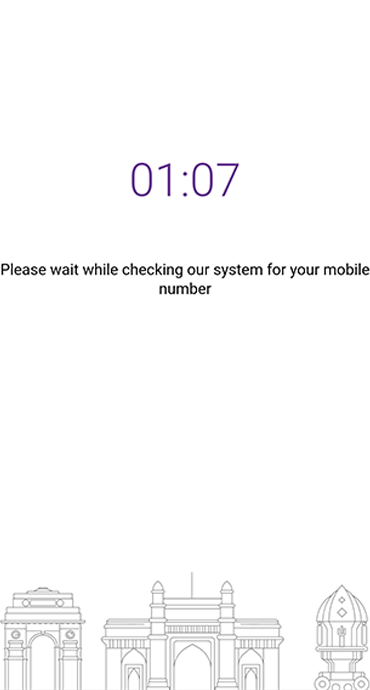

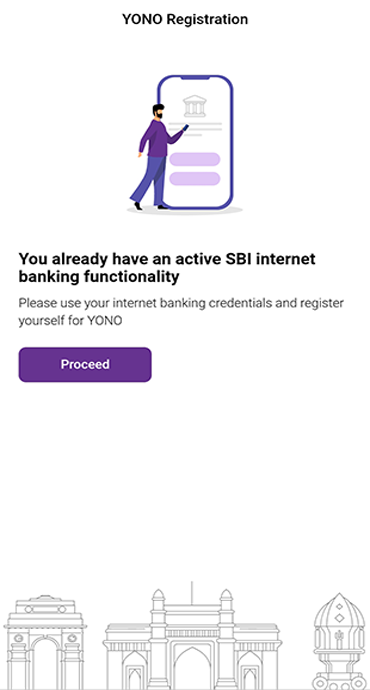

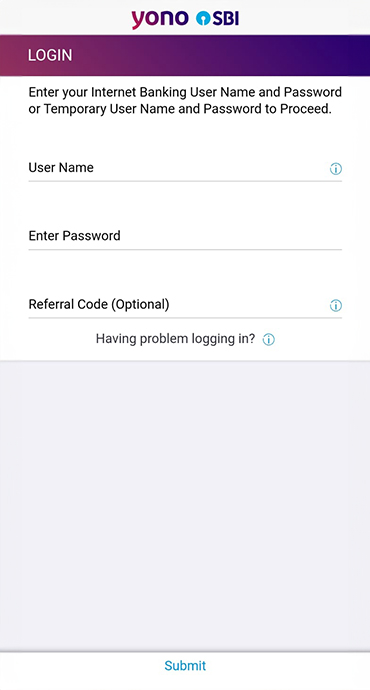

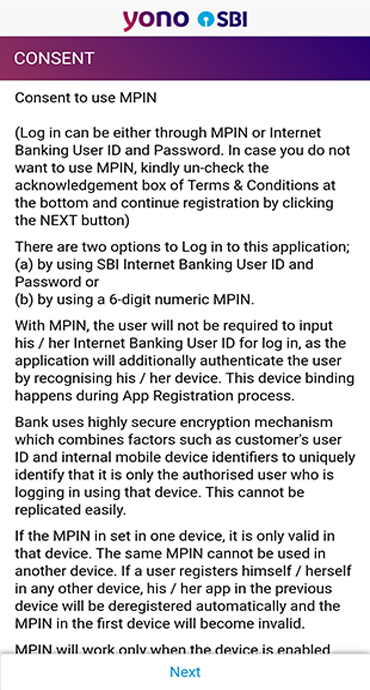

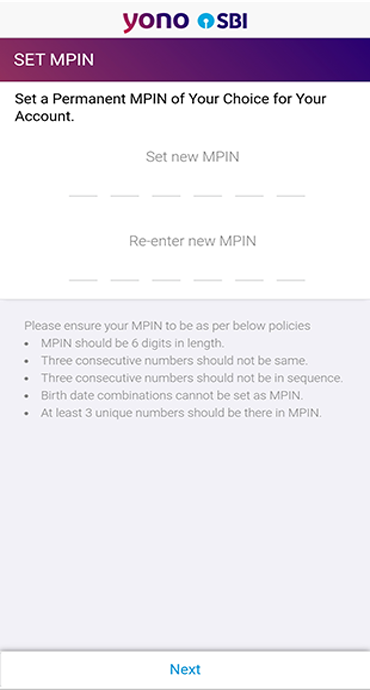

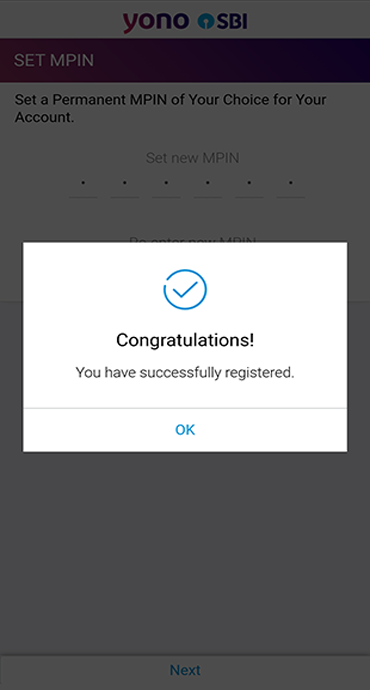

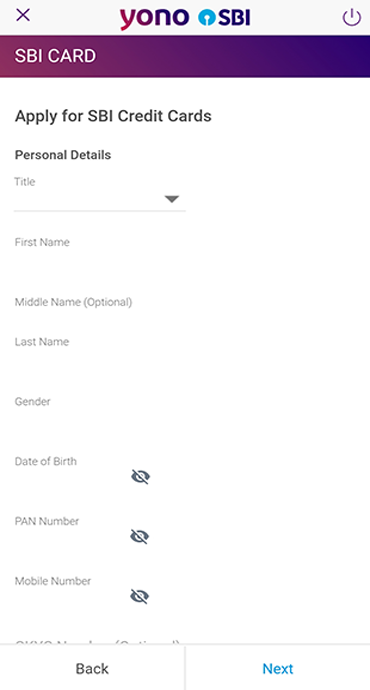

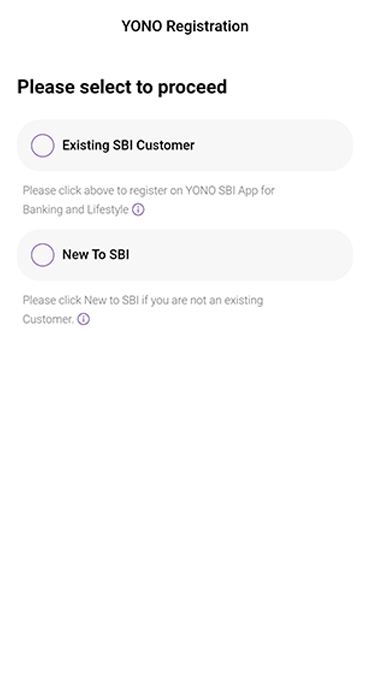

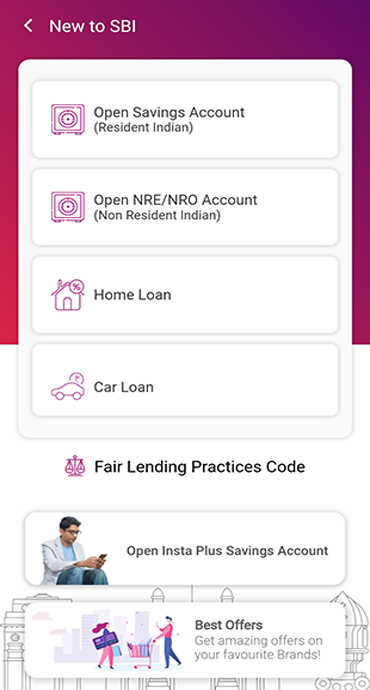

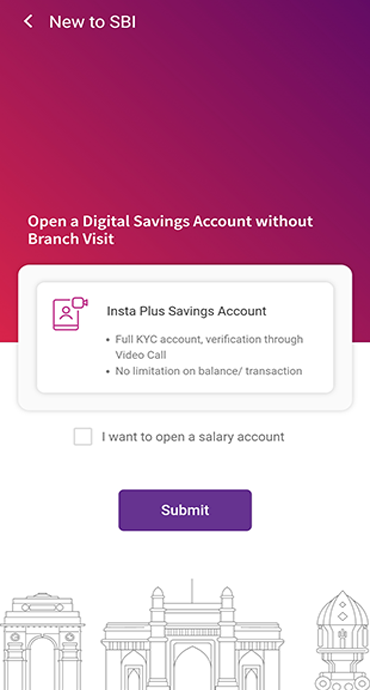

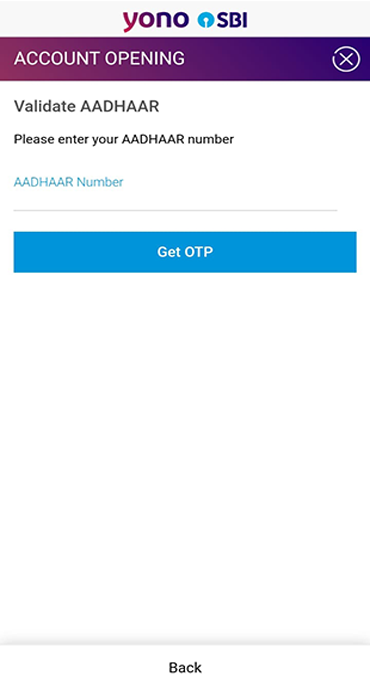

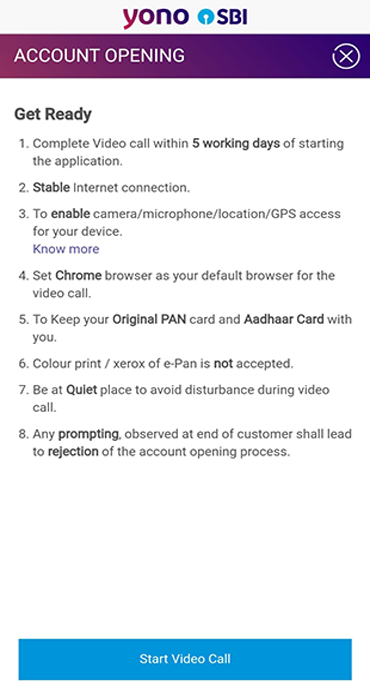

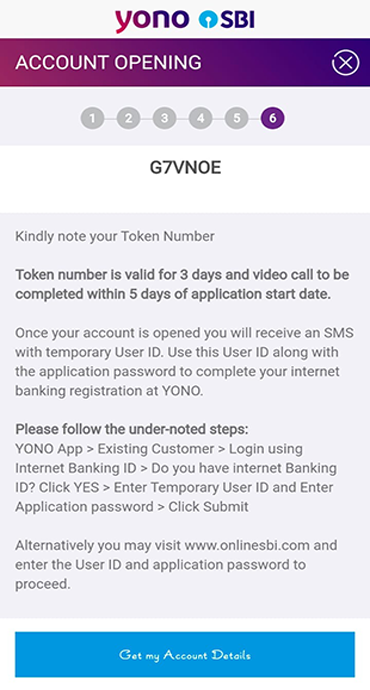

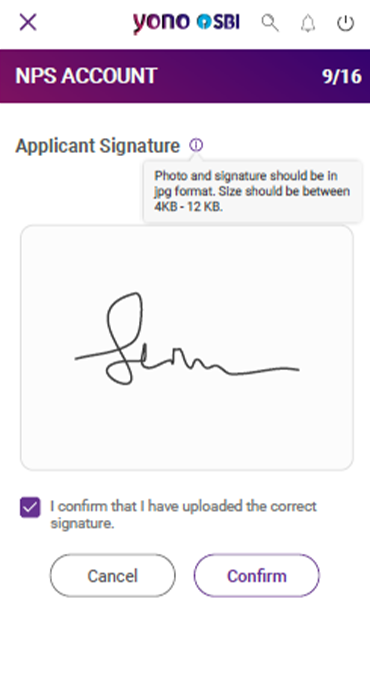

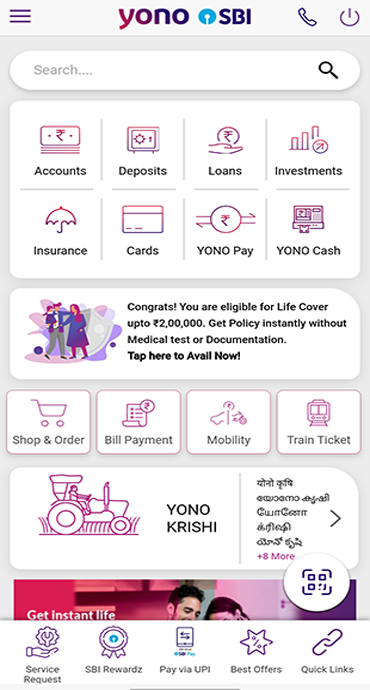

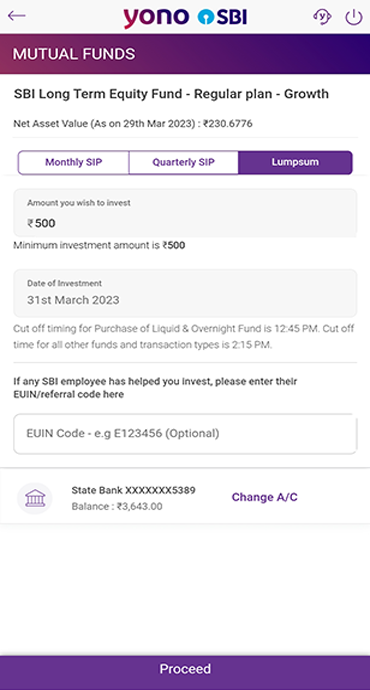

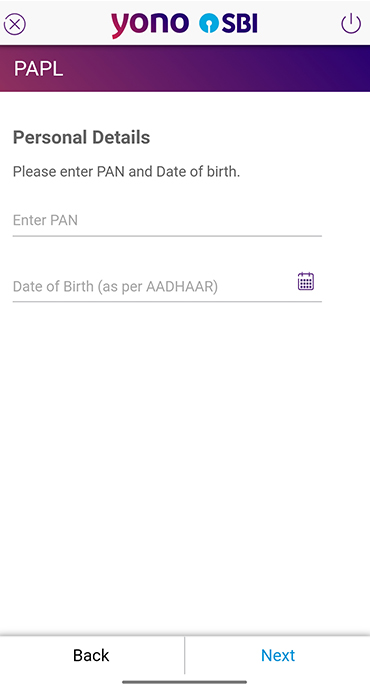

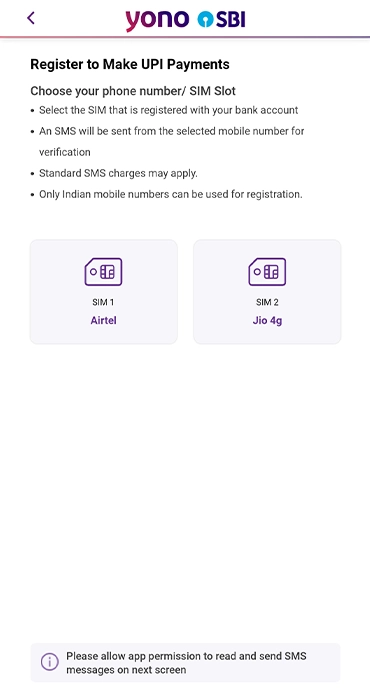

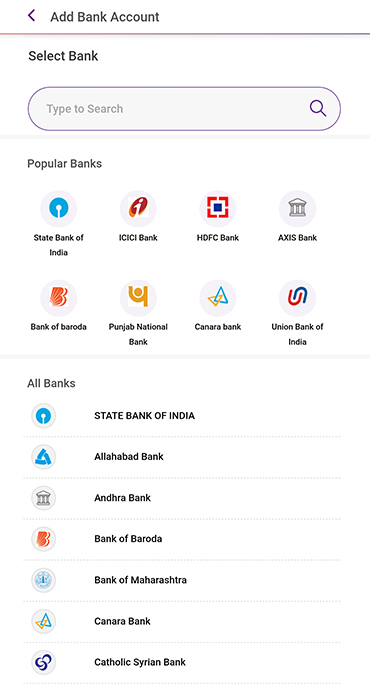

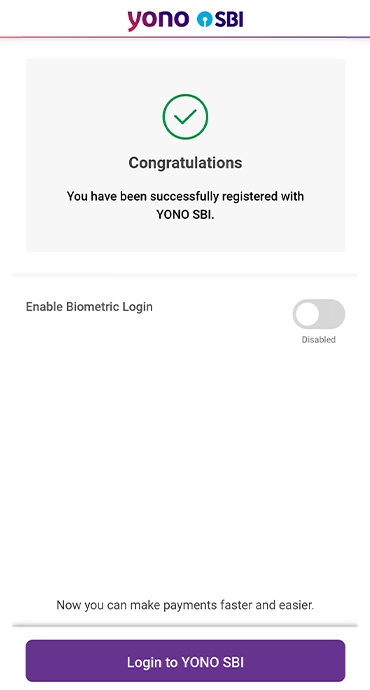

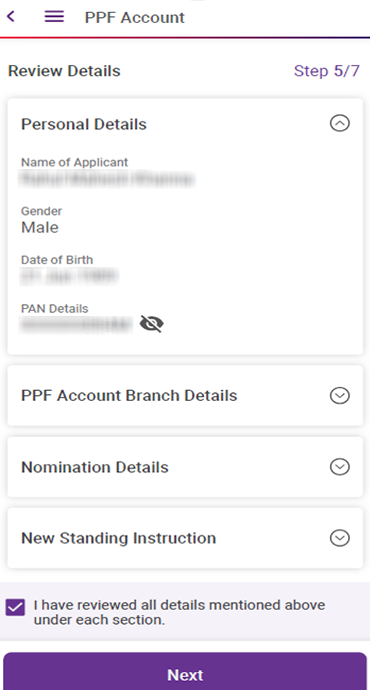

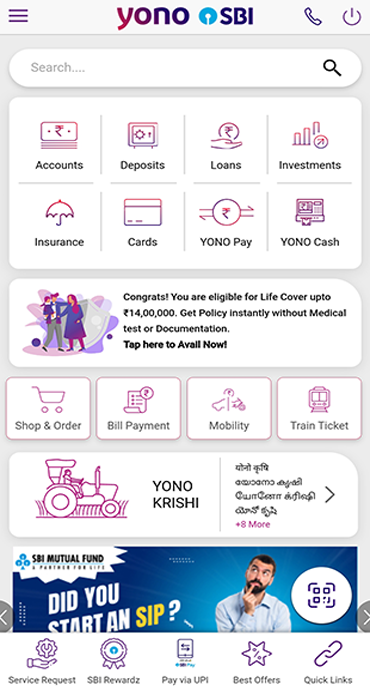

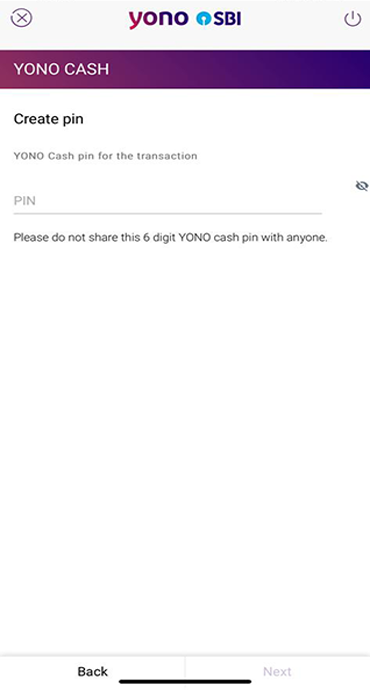

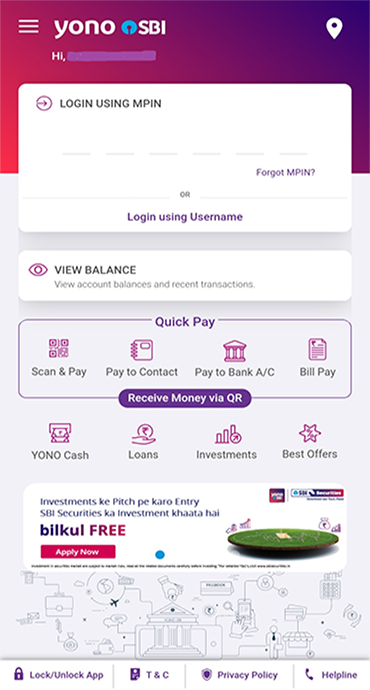

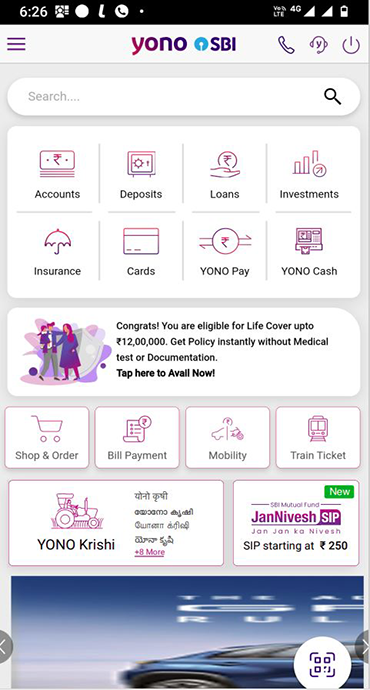

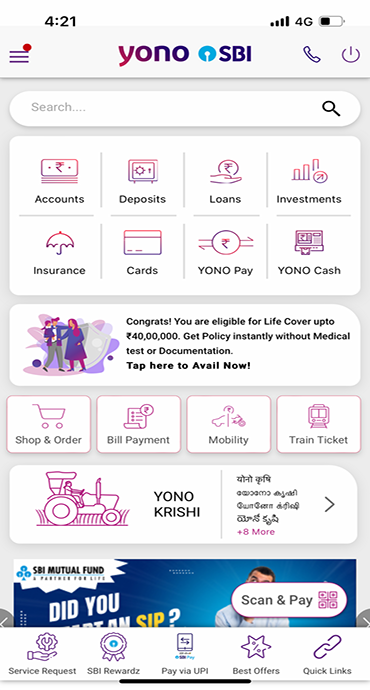

Step 1: Access YONO SBI-

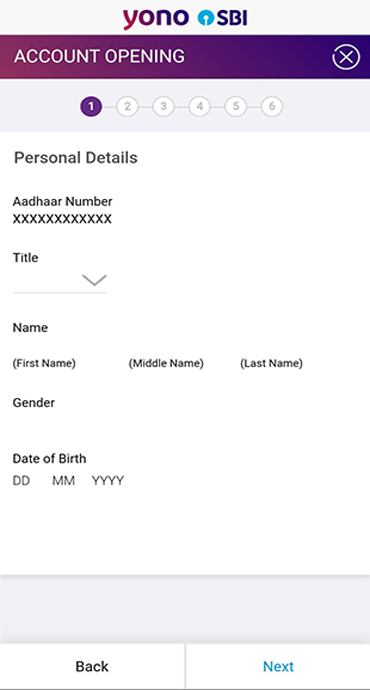

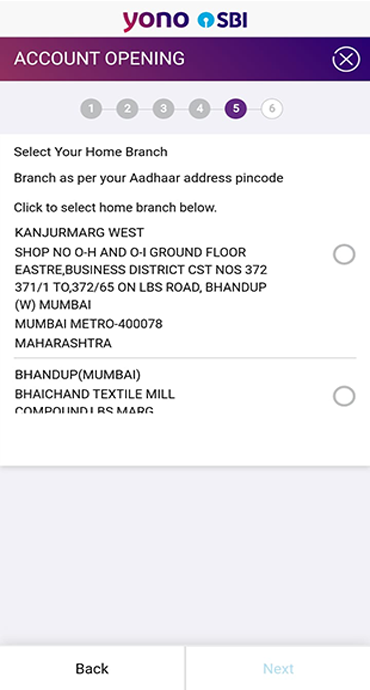

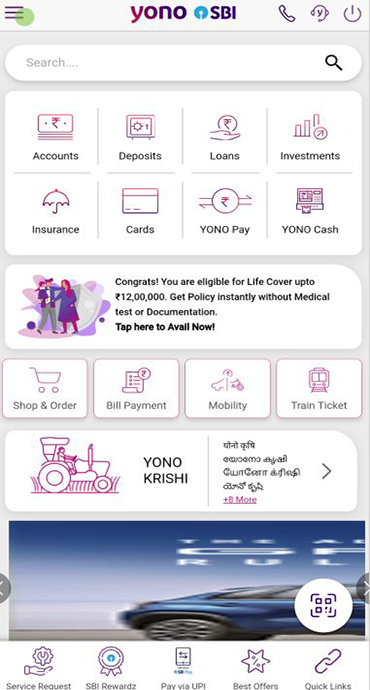

Log in to YONO SBI using your registered credentials. If you are not registered, complete the registration process first to access online car financing options.

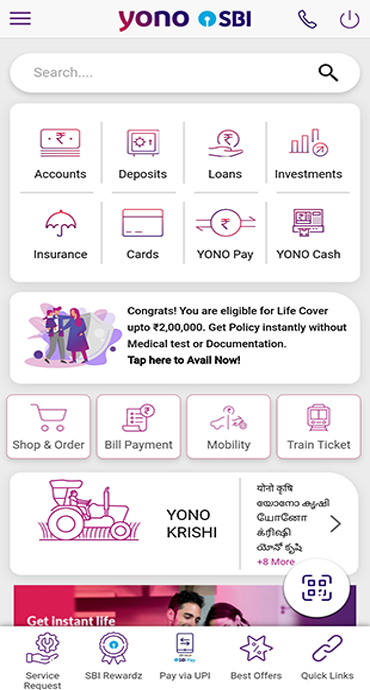

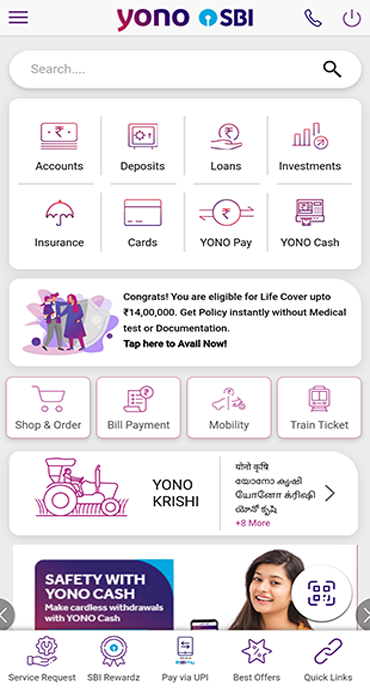

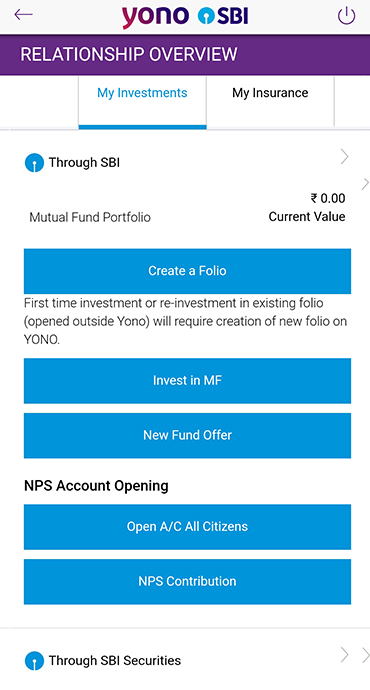

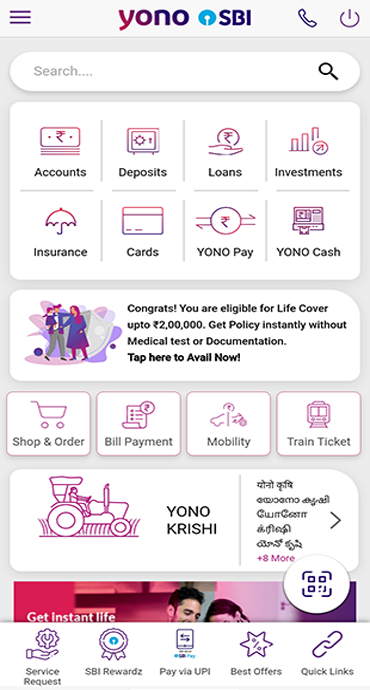

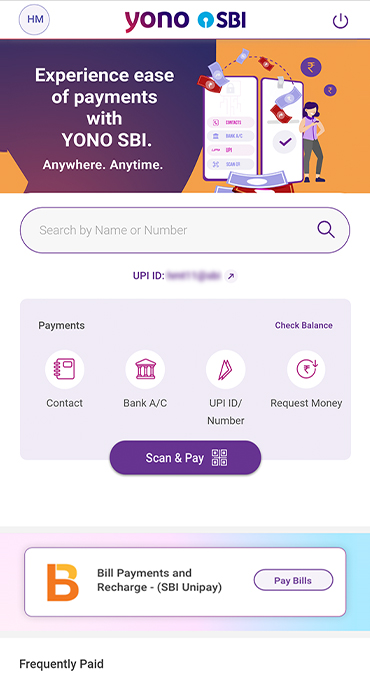

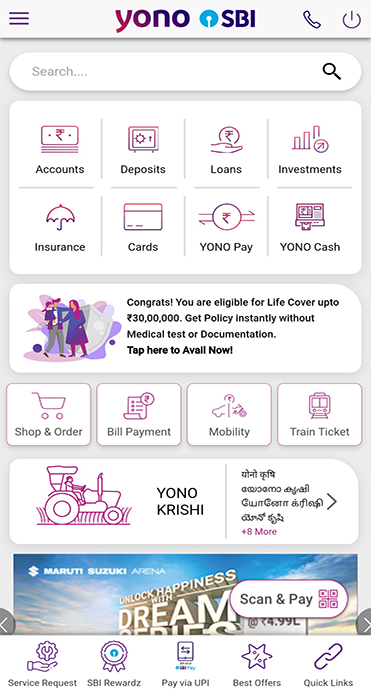

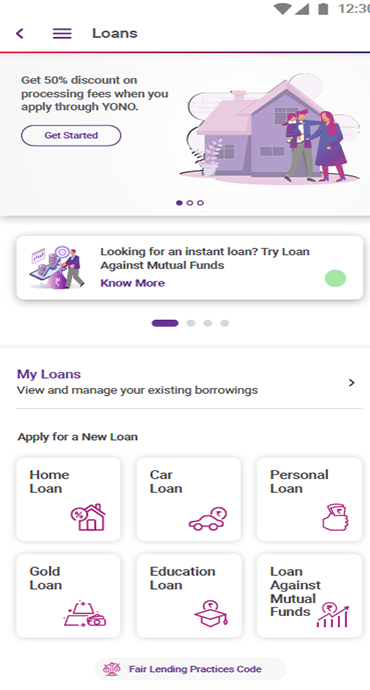

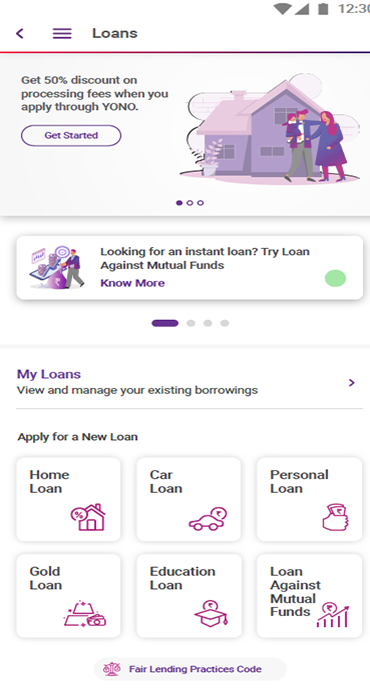

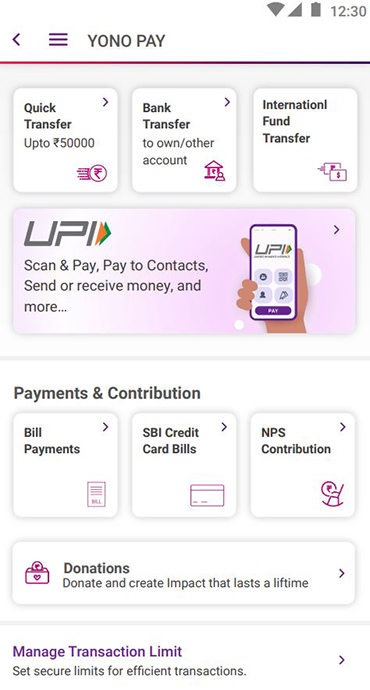

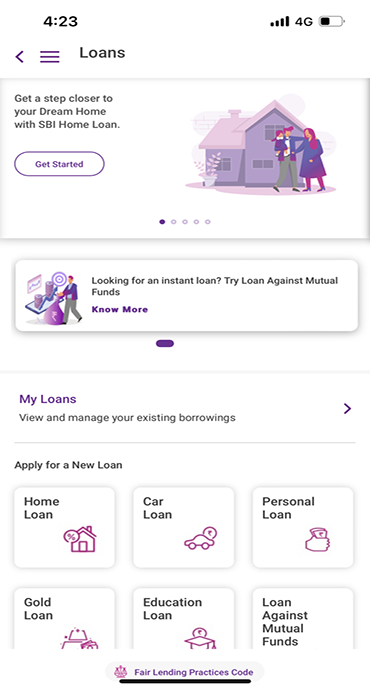

Step 2: Navigate to Car Loan section-

From the main dashboard, select 'Loans' and then choose 'Car Loan' from the available options.

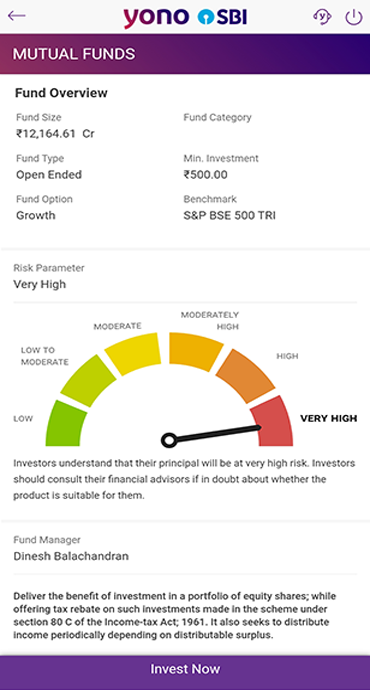

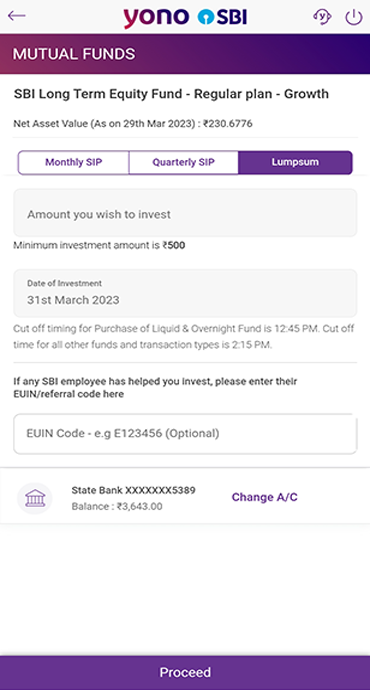

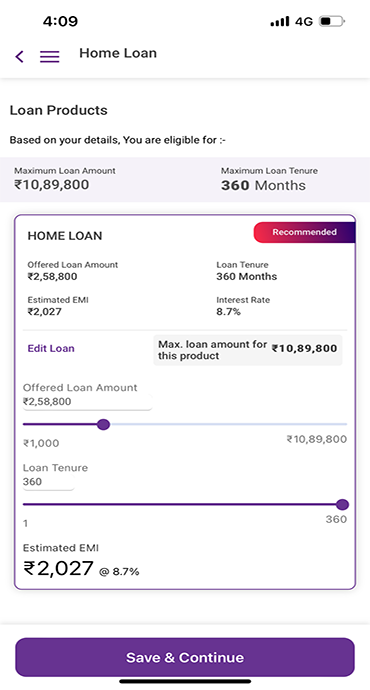

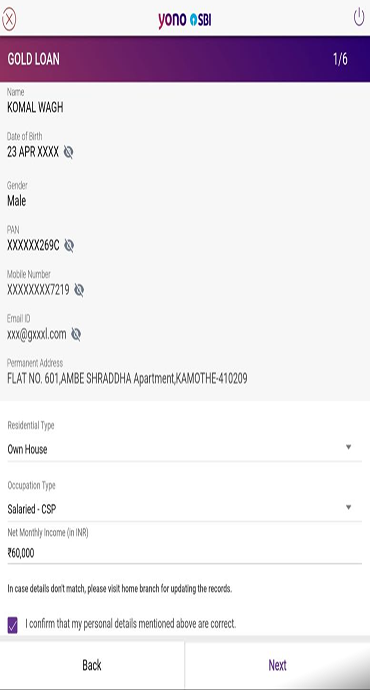

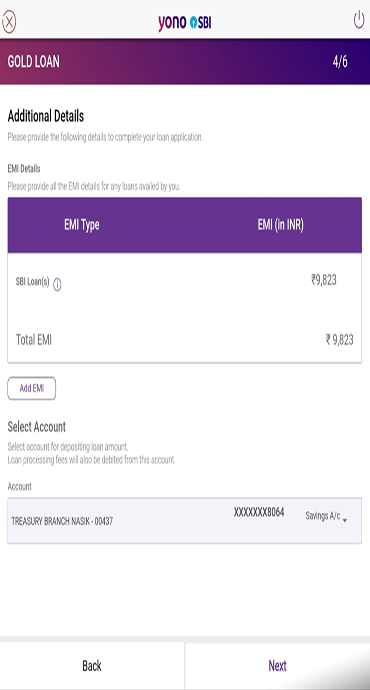

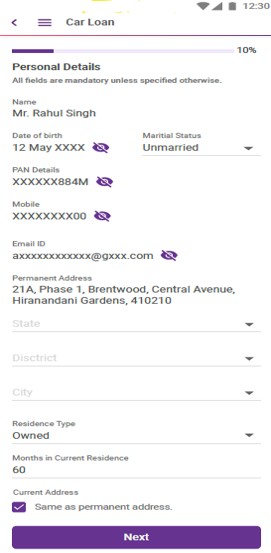

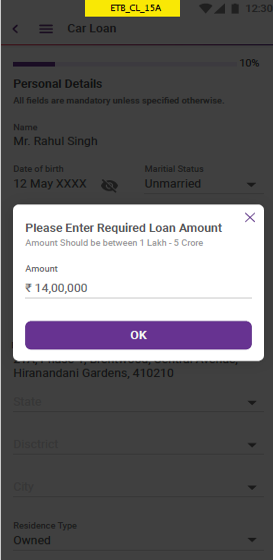

Step 3: Check Instant Eligibility-

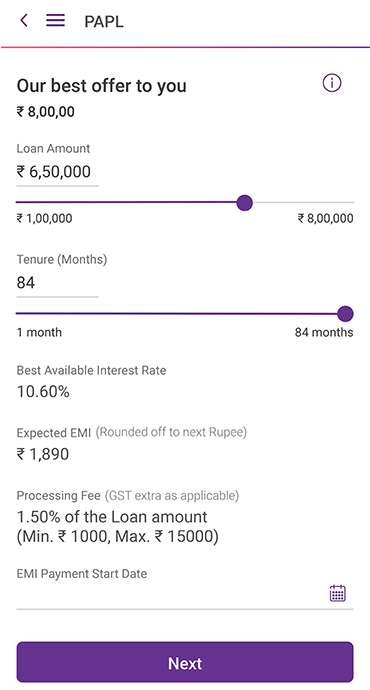

Enter your basic personal and financial information to receive immediate feedback on your car loan eligibility, including eligible loan amount and applicable interest rates.

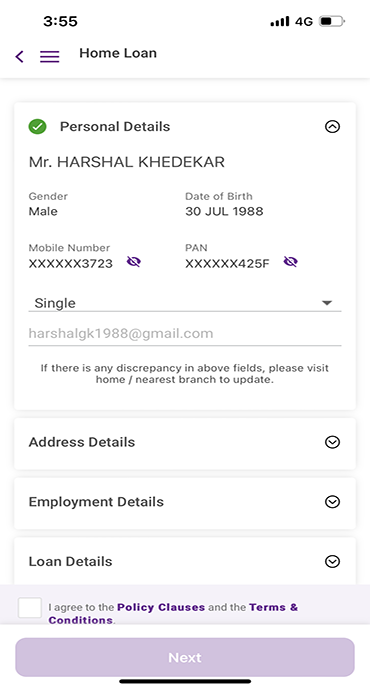

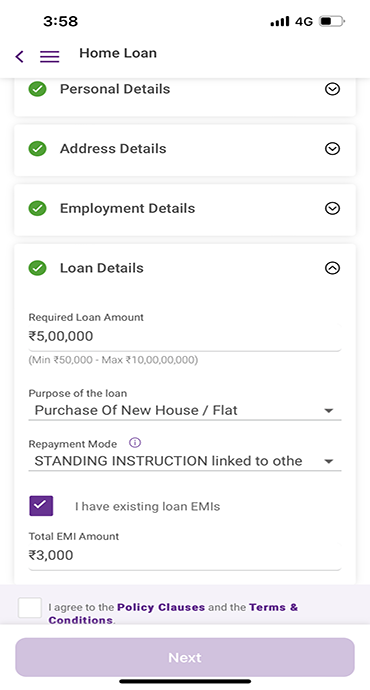

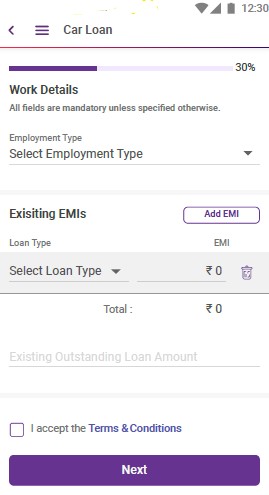

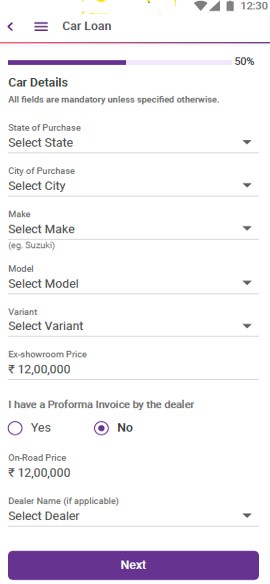

Step 4: Complete Application -

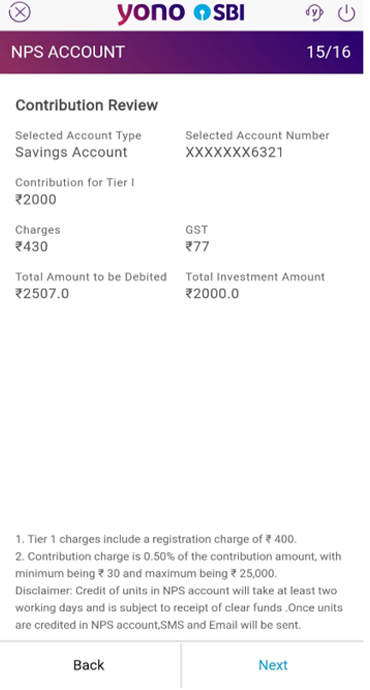

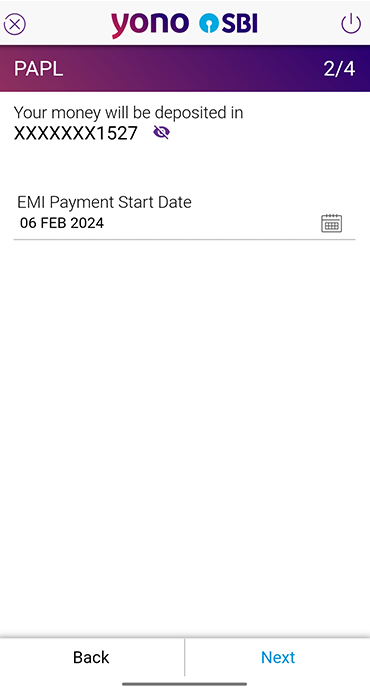

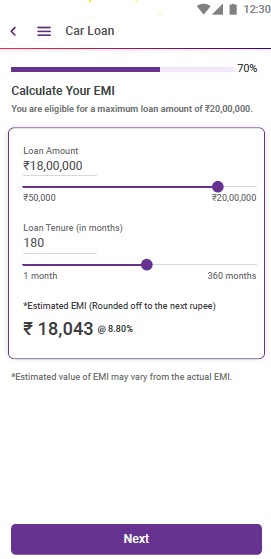

Fill out the comprehensive application form with accurate details about your employment, income and the vehicle you intend to purchase. Use the car loan EMI calculate feature to determine your comfortable EMI amount.

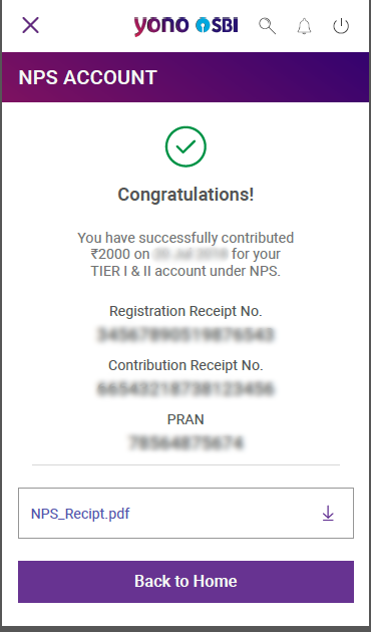

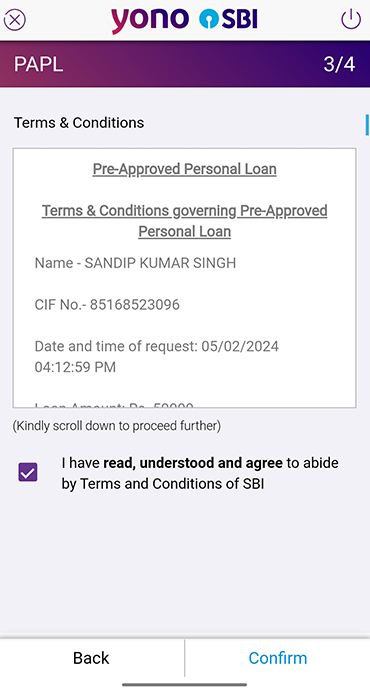

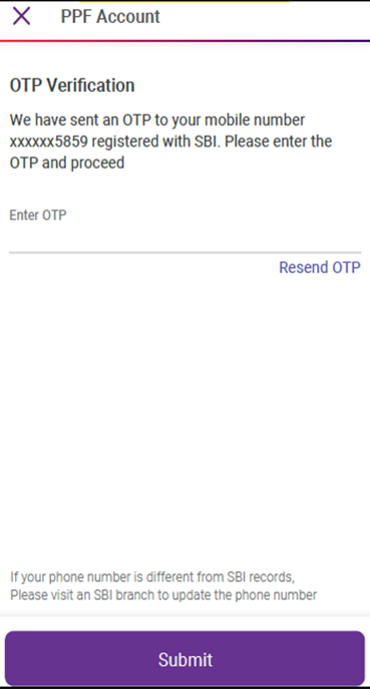

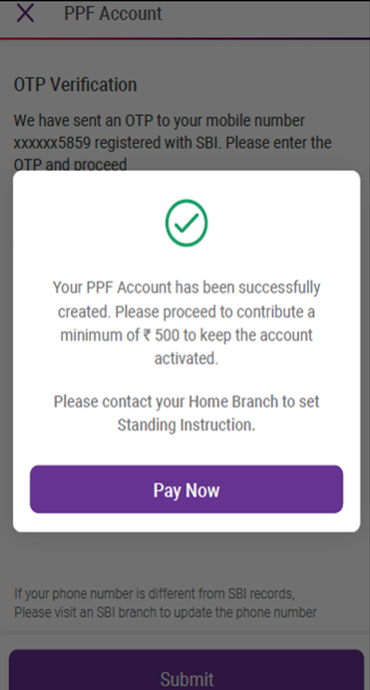

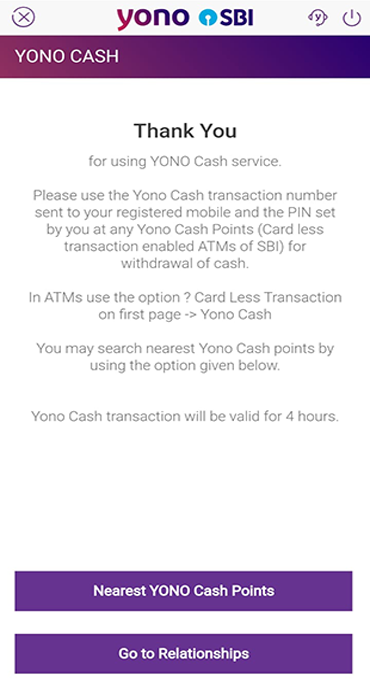

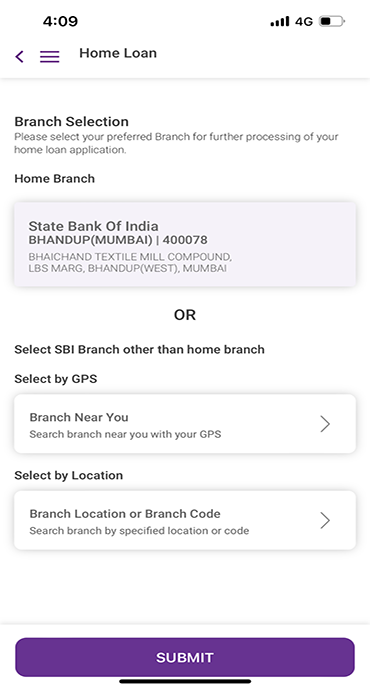

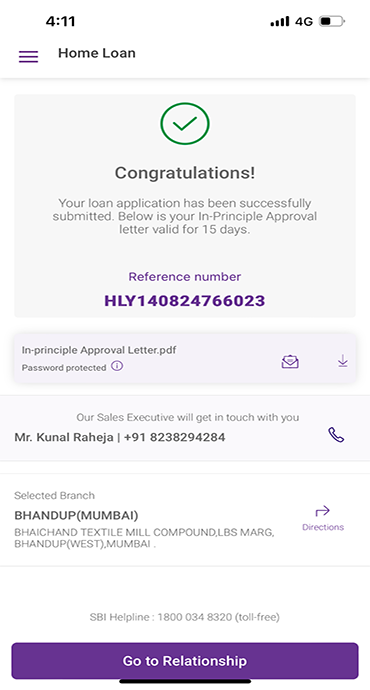

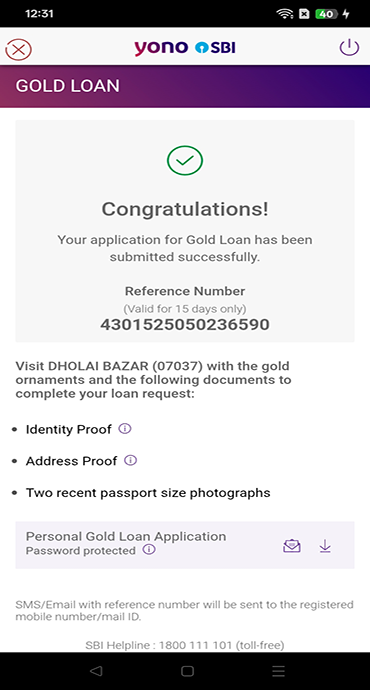

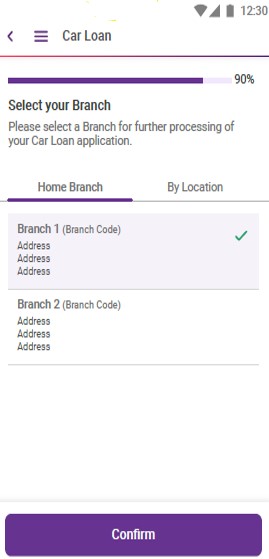

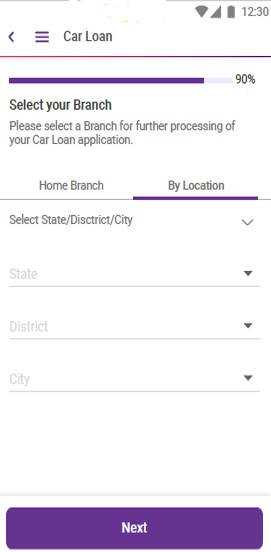

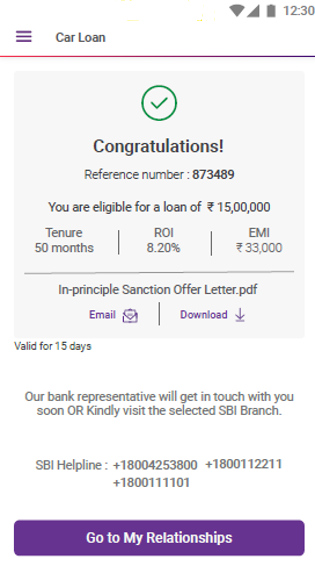

Step 5: Submit & Download-

Submit the application and receive In-Principle sanction letter by downloading as per your eligibility.

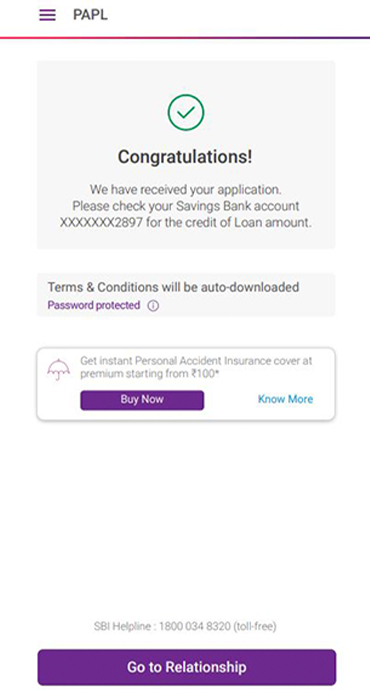

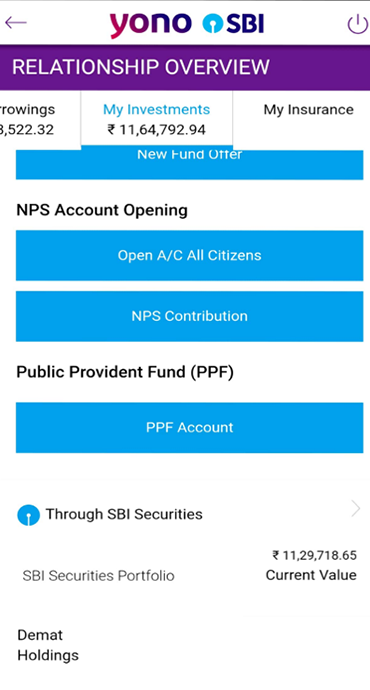

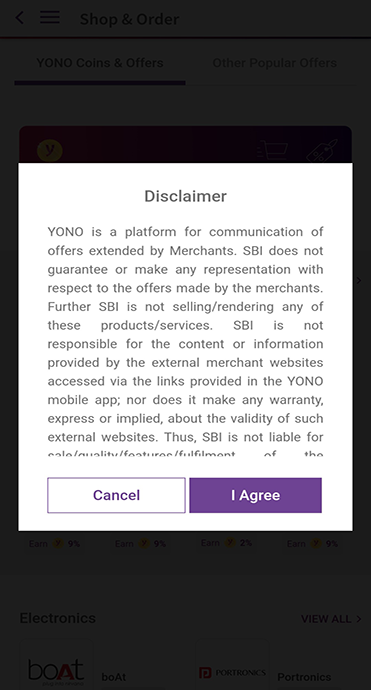

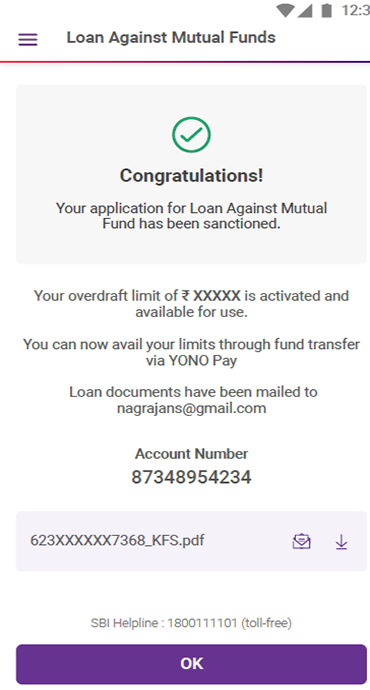

YONO SBI Advantage: Instant Car Loan

Car loan eligibility checking using YONO SBI offers several digital advantages that set it apart from traditional application processes:

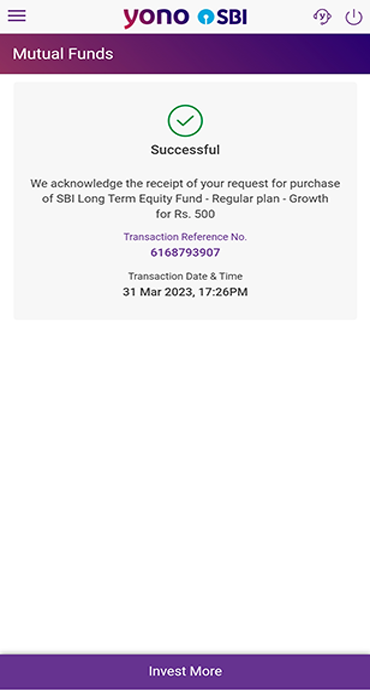

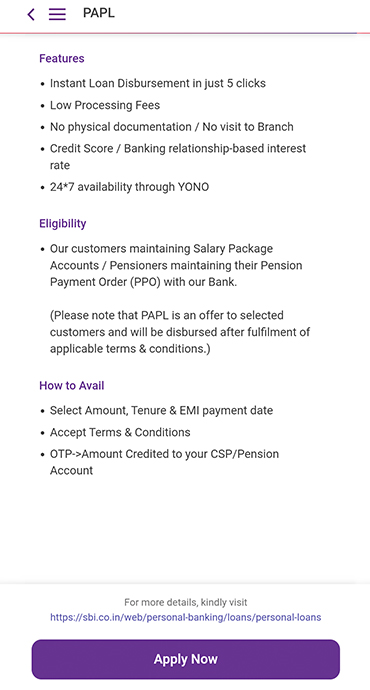

Instant Pre-approval:

The YONO SBI platform provides immediate In-Principle approval for eligible customers, giving you instant clarity on your loan amount. This instant car loan eligibility assessment streamlines your financing journey.

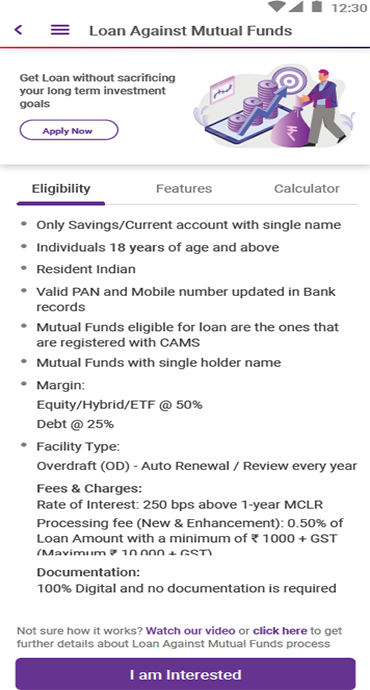

Extended Financing Options:

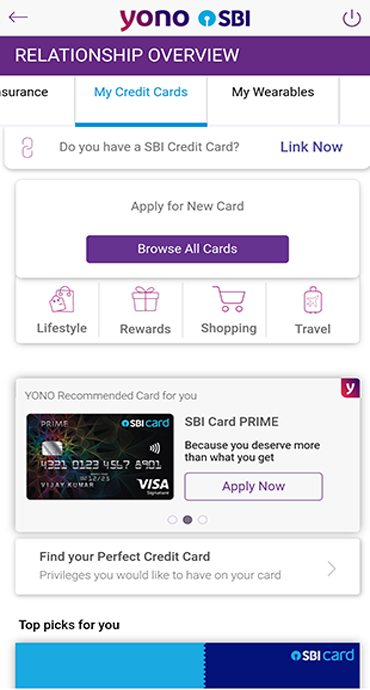

YONO SBI offers financing upto 100% for car's on-road price with tenures extending up to 7 years. Compare different auto payments options to find the best car loan interest rates suited to your financial situation.

24/7 Accessibility:

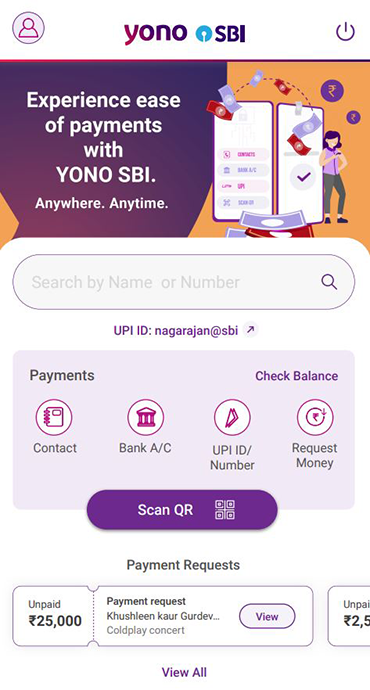

YONO SBI allows you to check eligibility, apply and track your application status anytime and anywhere through online car financing.

Conclusion

Understanding car loan eligibility and car loan criteria in India doesn't have to be complicated. The key is maintaining good financial health through timely payments, stable income and smart debt management. Whether you want to check car loan eligibility online or calculate car loan EMI, platforms like YONO SBI make the process faster and more transparent.

With features to calculate car loan eligibility, checking car loan eligibility instantly and comparing car loan interest rates across different financial institutions, there's never been a better time to turn your car dreams into reality as SBI offers better rate of interest.

Ready to check car loan eligibility?

Download the YONO SBI app today and get instant car loan approval with competitive car loan interest rates. Your dream car is just a few taps away – calculate car loan eligibility now and drive home your perfect vehicle sooner than you think!

आपकी रुचि से संबंधित ब्लॉग