Digital Arrest: Stay One Step Ahead of Cyber Threats| SBI - Yono

Digital Arrest Scams: How to Protect Yourself from Cybercriminals posing as Government Officials

24 Sep, 2025

cybersecurity

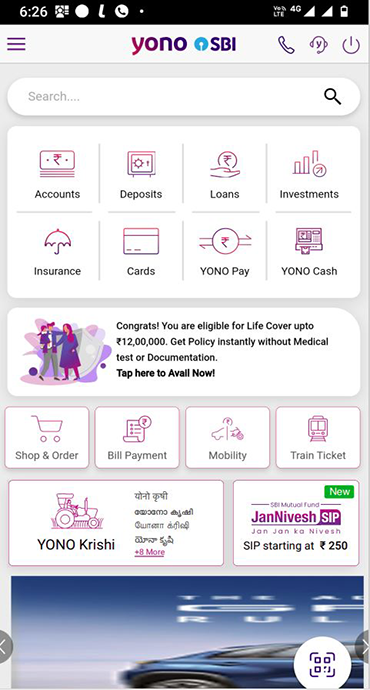

While digital transactions have revolutionised banking in India, they have also posed emerging threats from cybercriminals. Among the most alarming trends in cybersecurity in banking is the rise of "Digital Arrest" scams - sophisticated digital fraud where cybercriminals impersonate government officials to extort money from innocent citizens.

State Bank of India (SBI) is committed to protecting customers from all forms of digital crime. Understanding how these scams operate is crucial for maintaining online banking security and protecting yourself from banking fraud and phishing scams.

What is a Digital Arrest in Cybersecurity?

Digital Arrest is a cybercriminal scam where fraudsters impersonate law enforcement officers like CBI/Custom officials/Police/Judge or other government authorities to threaten and intimidate victims into transferring money in accounts of other individuals. These digital crime schemes exploit fear and urgency to pressurise victims to take hasty financial decisions.

How Digital Arrest Scams Work

- False Contact : Cybercriminals call individuals claiming to be from CBI, Enforcement Directorate, Customs, Judge, Police or other government departments using spoofed official numbers.

- Fake Settings: Cybercriminals may reach out via video calls as well wearing fake uniforms of government officials in fake settings of government offices.

- Fake Accusations: Cybercriminals will accuse victims of committing serious crimes like money laundering or drug trafficking.

- Intimidation: Fraudsters threaten immediate arrest or asset seizure to create panic.

- Digital Arrest Claim: Cybercriminals claim the victim is under "digital arrest" and force them to follow their instructions.

- Isolation: Cybercriminals instruct victims not to contact family or real authorities.

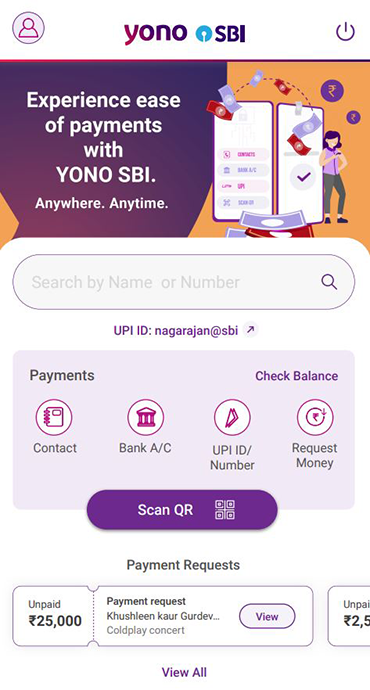

- Financial Extortion: Victims are pressurised to transfer money as "bail amount" or "verification fee".

- Disappearance: Victim is no more able to connect to cybercriminals after money is transferred.

Recent Digital Arrest Scam Examples

Case Study 1 - The Fake CBI Officer:

A retired government employee in Mumbai received a call from someone claiming to be a CBI officer, accusing him of money laundering activities. The fraudster sent fake arrest warrants and demanded ₹2.5 lakhs as "security deposit." The victim became suspicious when asked to transfer money through UPI and reported to local police, avoiding a significant loss.

Case Study 2 - The Customs Department Scam:

A software engineer in Bangalore was told her Aadhaar card was linked to a drug trafficking case. The caller, posing as a customs official demanded ₹5 lakhs to "clear her name." Quick thinking and verification with actual Customs Department through official channels helped her realise it was a digital scam.

Case Study 3 - The Digital Arrest Isolation:

An elderly citizen in Delhi was kept on video call for six hours by scammers claiming to be from ED (Enforcement Directorate). They threatened asset seizure and demanded ₹8 lakhs. Family members' intervention and immediate police reporting prevented the fraud.

Key Red Flags for Identifying Digital Arrest Scams

- Creation of urgency through threats of immediate arrest

- Use of official-sounding language and terminology

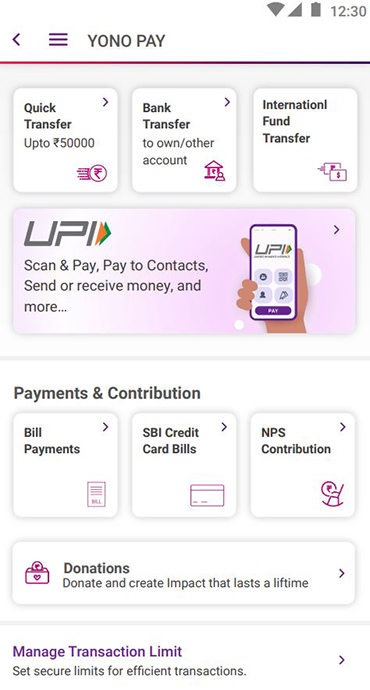

- Demanding immediate money transfer through digital channels like UPI or bank transfer

- Asking for banking credentials- user id, password, ATM pin or OTPs

- Threatening with arrest without proper legal documentation

- Requesting remote access to devices or accounts

- Isolation tactics preventing victims from seeking help

Mechanisms That Help Stay Protected

Robust mechanisms have been implemented to help customers stay protected from fraudulent activities:

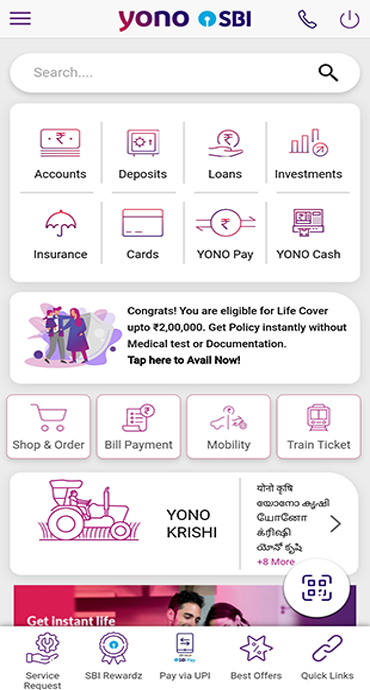

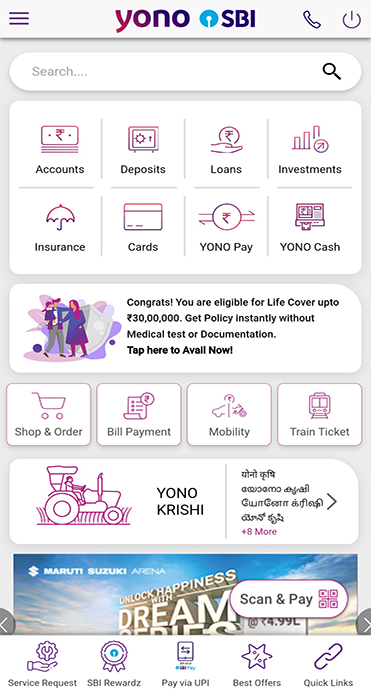

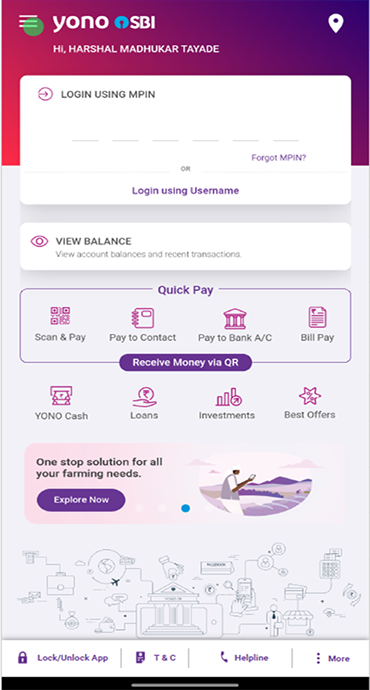

Advanced Fraud Detection Systems: SBI's systems monitor unusual transaction patterns that may indicate suspicious transactions.

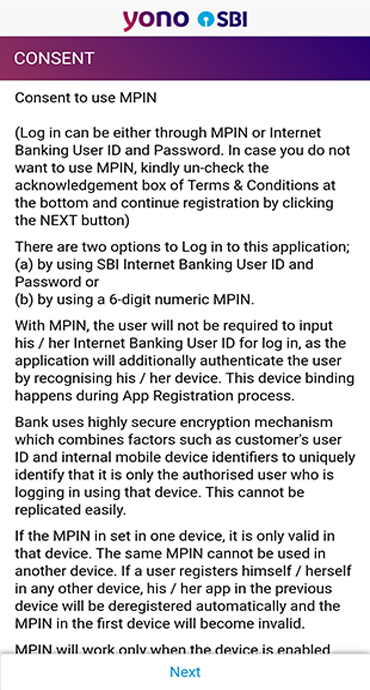

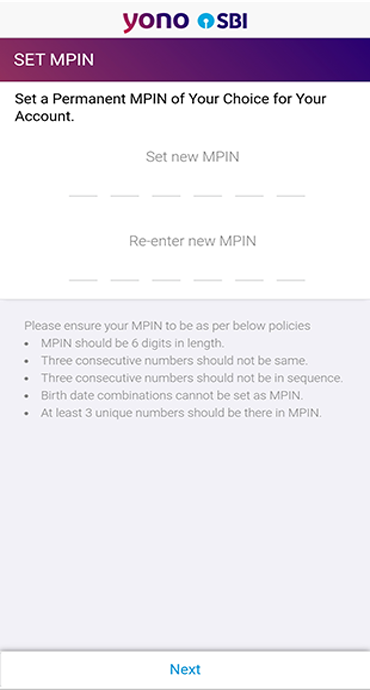

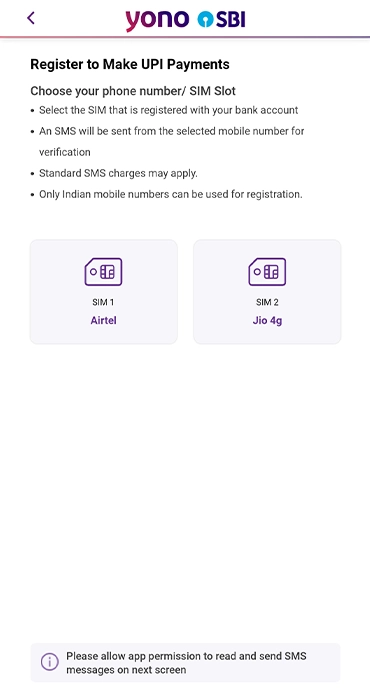

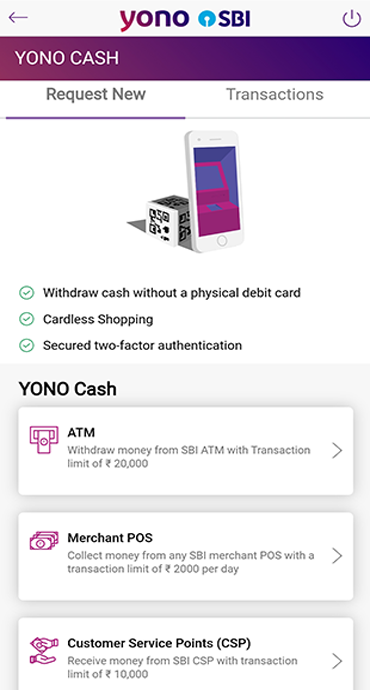

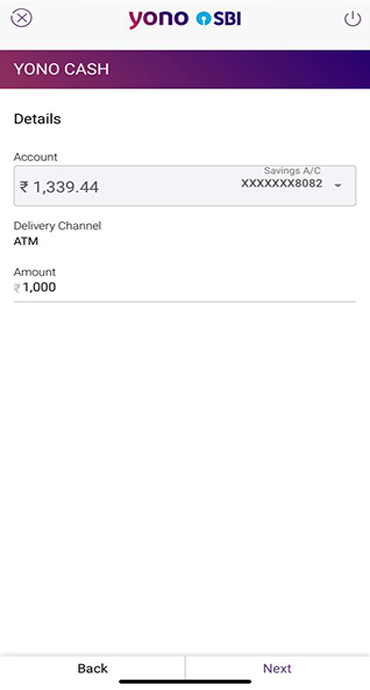

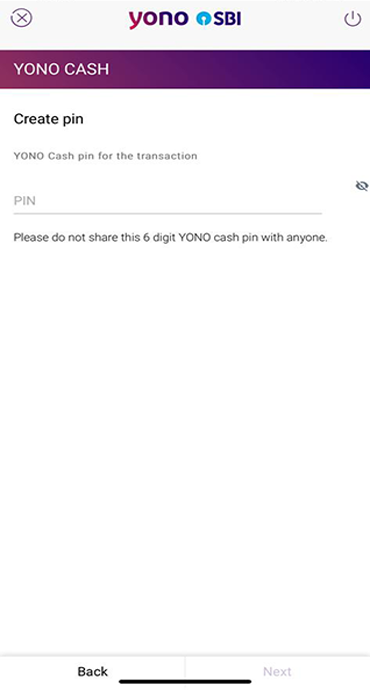

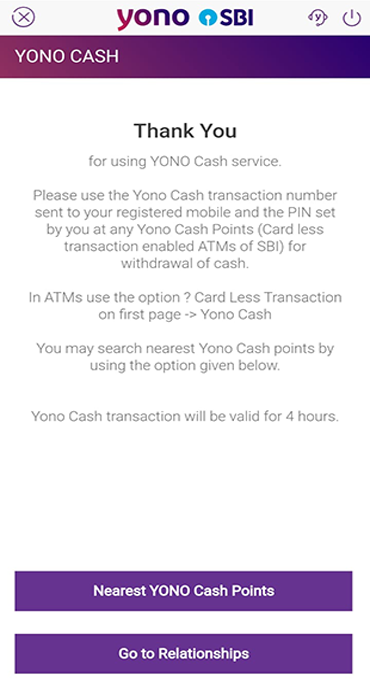

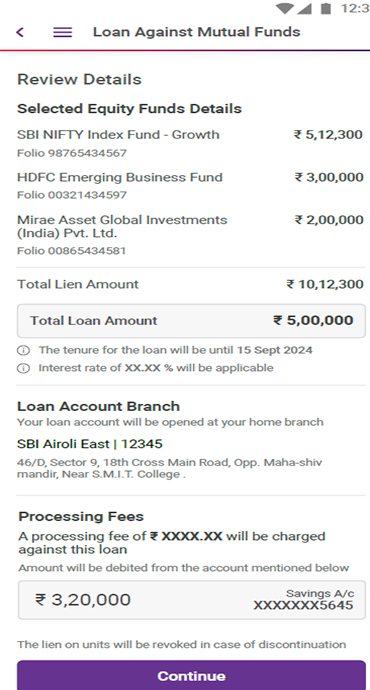

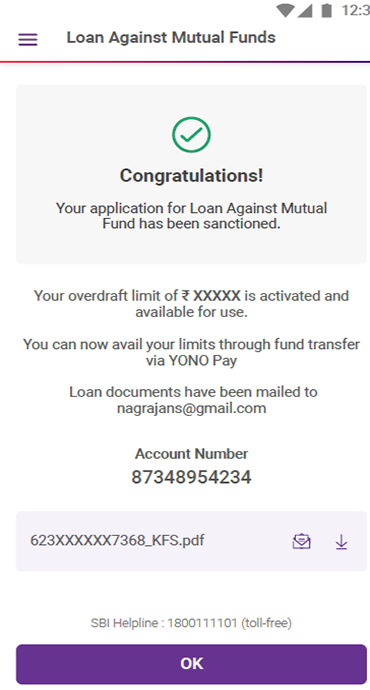

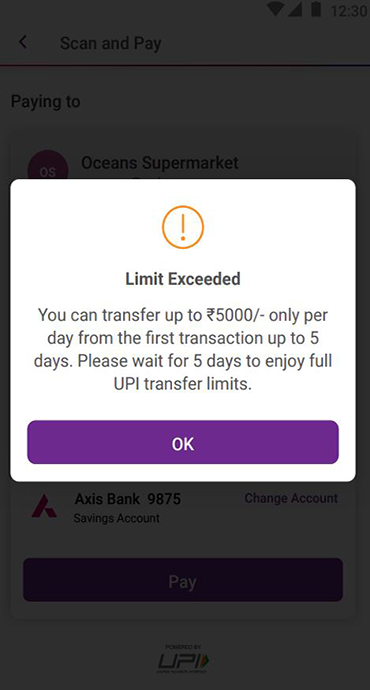

Mobile Banking Security: Features like device binding and transaction limits help prevent unauthorised access even if scammers obtain basic account information.

Digital Banking Monitoring Tools: SBI provides comprehensive account monitoring tools including transaction history, login details and device management features.

Real-Time Transaction Alerts: Immediate SMS and email notifications for all digital transactions help customers quickly identify unauthorised activities.

Customer Education and Awareness: SBI regularly conducts awareness campaigns about Digital Arrest scams and other fraud schemes.

Secure Communication Protocols: SBI never asks customers for sensitive information like User-id, Password, PIN, or OTPs.

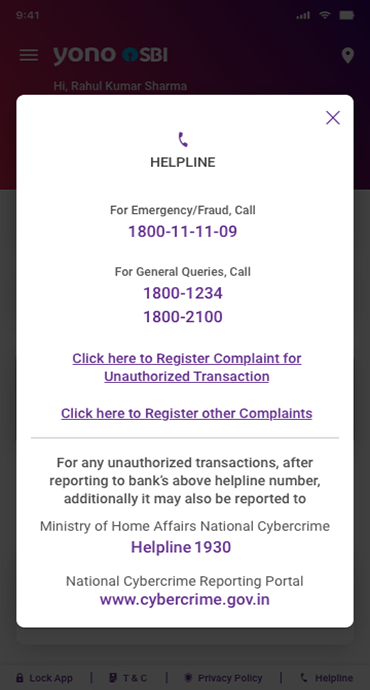

24/7 Customer Support SBI's dedicated helpline number is available to help customers who suspect they are being targeted by Digital Arrest.

Transaction Cooling Period: For high-value transactions to new beneficiaries, SBI implements cooling periods as additional security measure.

How to Protect Yourself from Digital Arrest Scams

- Disconnect suspicious calls immediately and verify independently through official channels.

- Update passwords, monitor accounts and maintain transaction alerts.

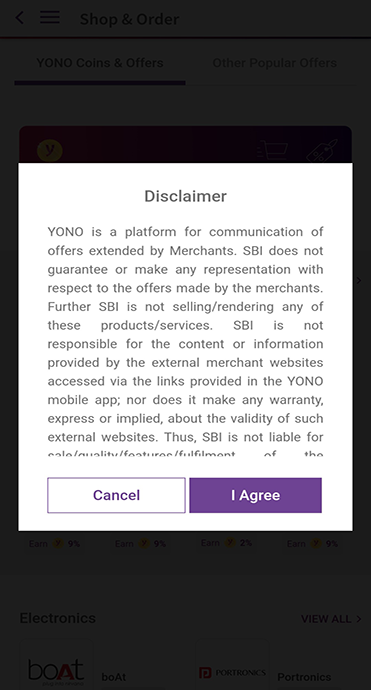

- Never share sensitive information like user-id, passwords, pins or OTPs with any one, not even your banks representative.

- Never click on links sent by any unknown source.

- Never make financial transactions under threat or pressure.

- Fraudsters generally ask victims on call to transfer funds immediately through single transaction or series of transactions. Customers should exercise cooling period and stop further transferring fund in case of any suspicion.

- Utilise official government portals and helplines to verify any claims made by callers. The National Cyber Crime Reporting Portal (NCRP) provides resources for reporting and verification.

- Keep emergency contact numbers readily available, including SBI customer care, local police and cybercrime helplines.

- Inform bank through Customer Care about the fraudulent activity or through National Crime Report (NCRP) or by calling Cybercrime national helpline number 1930.

- Learn about latest scam techniques through official sources and share with family members. Access SBI's cybersecurity awareness materials, government advisory notifications help to stay updated. Understand legitimate government procedures and legal processes.

Government Resources and Helpline Numbers

National Cyber Crime Reporting Portal (NCRP)

- Website: www.cybercrime.gov.in

- Helpline: 1930 (National Cybercrime Helpline)

- Report online fraud, Digital Arrest scams and cyber crimes

Essential Contacts:

- Police Helpline: 100 (Emergency) / 112 (Integrated Emergency)

- RBI Complaint Portal: cms.rbi.org.in (for banking-related issues)

- SBI Customer Care: 18001234 / 18002100 / 1800112211 / 18004253800

Remember: Government agencies follow proper legal procedures and never demand immediate money transfer over phone calls.

Secure Your Digital Future With SBI

Digital Arrest scams are serious threats to online banking security but awareness provides complete protection. Remember that no legitimate government agency will ever threaten arrest or demand money transfer over phone or video calls.

SBI's security features, combined with your vigilance, create strong defence against these cybercriminal activities. When facing a Digital Arrest threat, your first action should always be verification through official channels, not to transfer money.

Stay alert, verify independently and protect your financial security through knowledge and smart digital practices. Your awareness is the best defence against Digital Arrest scams.

आपकी रुचि से संबंधित ब्लॉग